The FTSE 100 has been given an early lift today, bolstered by a 10% profit rise from HSBC that pushed the bank’s shares up by 5%, just ahead of the UK’s budget announcement. UK markets remain positive, fueled by the strong close in US jobs indices, despite anticipated volatility surrounding upcoming economic data. Investors are also closely monitoring the chancellor’s budget, which aims to address public finances through measures impacting both businesses and investors. Despite the likelihood of increased taxation, the pound has recently surged to multi-month highs against the euro, yen, and Australian and New Zealand dollars. Government borrowing is expected to increase, with updated fiscal calculations potentially providing greater investment headroom to support economic growth.

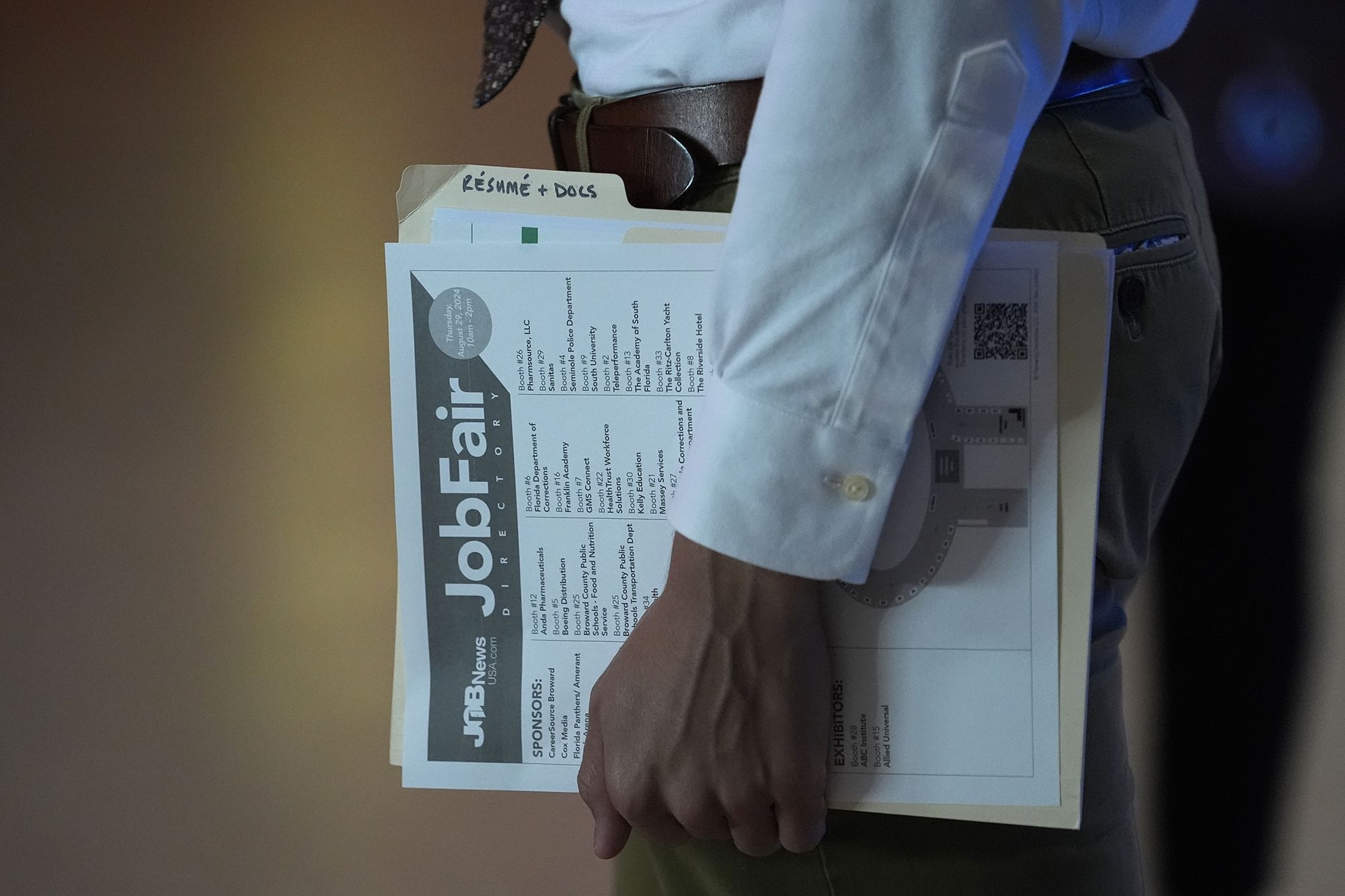

In the US, markets anticipate a downturn in job data, with today’s JOLTS job openings report expected to show further decline following last month’s surprising 8.04 million openings. Eyes are also on upcoming ADP payrolls (forecasted to drop from 143,000 to 110,000) and non-farm payrolls (expected to fall from 254,000 to 108,000) as signs of economic cooling return. Meanwhile, rising US Treasury yields are drawing attention, as their impact on the Fed’s monetary policy is closely monitored.

In tech, Alphabet will kick off big earnings this evening as part of a significant three-day stretch, with five of the top seven tech companies reporting. The spotlight is on these companies’ AI investments, with Alphabet poised to focus on robust political advertising revenue during this critical US election period.